|

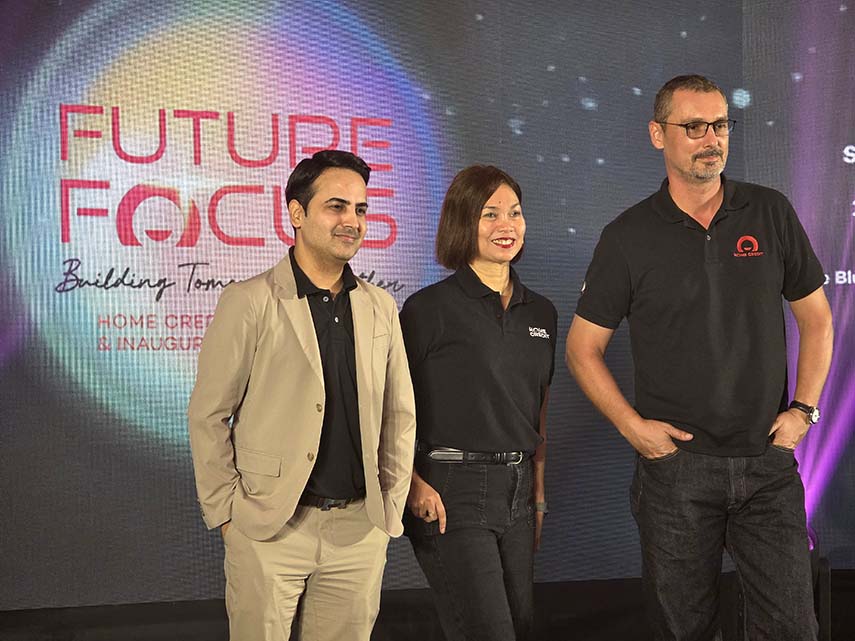

| L-R: Home Credit Philippines Chief Sales Officer Puneet Suneja, Home Credit Philippines Chief Marketing Officer Sheila Paul, Home Credit Philippines Executive Director and Chief Business Officer Zdenek Jankovsky (Image Source: MegaBites/Home Credit Philippines) |

Home Credit Philippines (HCPH), the country’s leading consumer finance company, has helped more than 12 million Filipinos access essential products and services, from smartphones and appliances to mobility and insurance. At its recent event entitled Future Focus: Building Tomorrow Together, HCPH revealed that it has financed 2.5 million smartphones since the start of 2024 — an average of 5,000 devices per day already by August 2025. The company also reported strong growth across other product categories, underscoring how far it has come in just over a decade, evolving from a small retail booth to a nationwide financial partner trusted by millions.

From 33 Customers To 12 Million Loyal Customers

Since opening its first booth in 2013 with only 33 customers, HCPH has grown into the country’s leading consumer finance provider. Today, it reaches millions nationwide through 18,000 partner stores and a dedicated team of 10,000 sales associates. “Our journey has always been about empowering Filipinos to achieve more. From 33 customers from our first day to 12 million we’ve served today, every milestone reflects our mission of making modern living more attainable — whether through a smartphone, a home appliance, or mobility solutions,” said HCPH Chief Sales Officer Puneet Suneja.

Premium Smartphones Made Affordable For Every Filipino

iPhones remain the top choice for many Home Credit users looking to upgrade to a premium device. Financing for these smartphones reached Php10B (10 billion pesos) in 2024 and is expected to hit Php20B (20 billion pesos) by the end of 2025 — double the previous year’s volume.

Enhancing Comfort At Home, On The Road

HCPH also plays a role in modernizing Filipino households. Refrigerators, televisions, and air conditioners remain top choices among financed items. During Home Credit’s peak season, the company financed an average of 700 refrigerators, 1,400 televisions, and 1,100 air conditioners per day, highlighting strong demand for comfort and convenience at home. Mobility, on the other hand, has emerged as a rapidly growing category in the Philippines. According to motorcycledata.com, the country ranks as the fifth largest motorcycle market in the world, highlighting strong local demand. Recognizing this trend, HCPH makes motorcycles and e-bikes more accessible through flexible financing options, enabling more Filipinos to enjoy convenient and affordable mobility. Since the start of 2024, HCPH has financed close to 70,000 units motorcycles and e-bikes amounting to Php4.5B (4.5 billion pesos), providing customers with not just transportation, but also greater independence in managing work, family, and leisure.

All-Around Consumer Protection, With Every Purchase

Beyond financing, HCPH also offers Home Credit Protect, a comprehensive program designed to give customers peace of mind without added financial strain. Users can choose between Borrower Protection, which covers accidents, life, illness, hospital cash, installment waiver, unlimited online consultations, and protection for borrowers and their families; or Device Protection, which safeguards against accidental liquid damage, offers extended warranty, fast door-to-door repair or replacement, and like-for-like device replacement. Suneja explained, “For as low as Php3 a day, the same price as a pandesal, customers can protect their purchases, extend product life, and secure coverage for themselves and their families. With Home Credit Protect, they don’t just safeguard their devices; they gain confidence knowing they and their loved ones are covered.” As of August 2025, Home Credit has already approved and released over Php1.75B (1.75 billion pesos) in claims with nearly 70,000 devices repaired or replaced under Home Credit Protect, showing strong customer trust.

Home Credit Strengthens Community Ties With Sports And Partnerships

At its Future Focus event, Home Credit Philippines presented a preview of its upcoming events and partnerships for the coming years. One of the highlights is the Home Credit Takbo #ParaSaLife in partnership with RunRio, happening on February 1, 2026 at the SM Mall Of Asia (MOA) Grounds in Pasay City and on March 29, 2026 at Citi De Mare in Cebu City. The company also announced its partnership with the University of Santo Tomas as sponsor as the school will be hosting Season 88 of the UAAP. Plus, Home Credit has teamed up with Cignal, the country’s most-subscribed pay television provider, to provide viewing access to Season 88 of the UAAP, the PVL Reinforced Conference, and the UAAP Season 88 Cheerdance Competition.

Driving Economic Growth

These achievements underscore the vital role consumer finance plays in the country’s economic and digital growth. Smartphone adoption, appliance upgrades, and mobility access fuel productivity, improve quality of life, and strengthen the Philippines’ position as one of Southeast Asia’s most dynamic consumer markets. “With our scale and expertise, Home Credit is not only serving individual customers but also contributing to economic activity. We are on track to exceed last year’s performance and will continue supporting a new generation of Filipinos seeking access to technology, comfort, and convenience in everyday life,” said HCPH Chief Marketing Officer Sheila Paul.

Reinforcing Leadership In Consumer Finance

Since entering the Philippine market in 2013, Home Credit has become a trusted leader in consumer finance — helping millions of Filipinos access essential goods and services through affordable installment plans, cash loans, and digital solutions. This milestone reflects the company’s unwavering commitment to making its credit solutions more accessible, especially for everyday needs. “Reaching 12 million customers is more than just a number — it’s a reflection of the trust Filipinos have placed in us. We’ve seen a significant increase in new customers compared to last year, driven by the growing demand for inclusive financing and the relevance and attractiveness of our offers,” said HCPH Chief Executive Officer David Minol. As of this writing, Home Credit has disbursed close to Php500B (500 billion pesos) in total sales across its dfferent credit offerings. This reinforces its position as a leading player in the consumer finance industry and highlights the growing demand for inclusive and accessible financial solutions. Now available in over 18,000 retail stores nationwide and a mobile app available on both Android and iOS, Home Credit oHers a seamless experience – from loan application to account management and payments. Its #ReadyToHelp sales force has grown to 9,000 strong and its portfolio now includes motorcyles, expanding its reach into mobility financing.

Looking Ahead: Financing What Matters

As it approaches its 12th year, Home Credit is focused on expanding its digital capabilities, launching customer-first products, and deepening partnerships across industries. But beyond innovation, its mission remains clear: to finance what matters most to Filipinos — whether it’s a first phone, a new appliance for their home or business or a way to get to move around the metro. Because for Home Credit, progress isn’t measured in pesos or percentages — it’s measured in the everyday wins of the people it serves.